income tax plus capital gains tax

This page walks Californians through what they need to know. Investors who fall in the middle brackets22 24 32 or 35pay 15 at most in.

Capital gains brackets are 0 15 and 20.

. The tax rate on most net capital gain is no higher than 15 for most individuals. The IRS stipulates that capital gains tax is applicable for taxpayers with modified adjusted gross income over certain thresholds. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Your short-term capital gains are taxed at the same rate as your marginal tax rate tax bracket. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Capital gains are taxable and capital losses reduce taxable income to the extent of gains plus in certain cases 3000 or 1500 of ordinary income.

Single taxpayers and those who are married and filing separate returns. Reason for bifurcation of capital gains into long-term and short-term gains The taxability of capital gains depends on the nature of gain ie whether short. Capital Gain Tax Rates.

Short-term capital gains are taxed at the same rate as federal income taxes which can be up to 37 while the highest long-term capital gains tax rate is 20 but can be either 0. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or.

Individuals currently pay a lower rate of. The capital gains tax is based on that profit. 2021 Capital Gains Brackets from the IRS.

Free version available for simple returns only. The threshold is 125000 for married. Short-term capital gainsfrom assets held for a year or lessare taxed as ordinary income at rates up to 37 percent while long-term capital gains are taxed up to 20 percent.

Report Inappropriate Content. In 2021 a single person can have a taxable income of 40000 or less and pay 0 in. For 2021 and 2022 individuals in the 10 to 12 tax bracket are still exempt from any tax.

You can get an idea from the IRS of what your tax bracket might for 2021 or. California makes no distinction. Capital gains taxes are progressive similar to income taxes.

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital. The tax rate on these gains ranges from 0 to 20 depending on your annual taxable income. If you are filing Married-Joint there is no capital gains tax on.

Tax as short-term capital gain. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. Some or all net capital gain may be taxed at 0 if your taxable.

The California capital gains tax is levied at the same rate as regular income. Capital Gains and Income Tax Bracket. In tax year 2021 the 0 tax rate on.

Check if your assets are subject to CGT exempt or pre-date CGT. No it doesnt include the capital gains itself. Applies to married taxpayers who file joint returns with taxable incomes up to 80800 and to single tax filers with taxable.

Short-term gains are taxed as ordinary income. Weve got all the 2021 and 2022 capital gains.

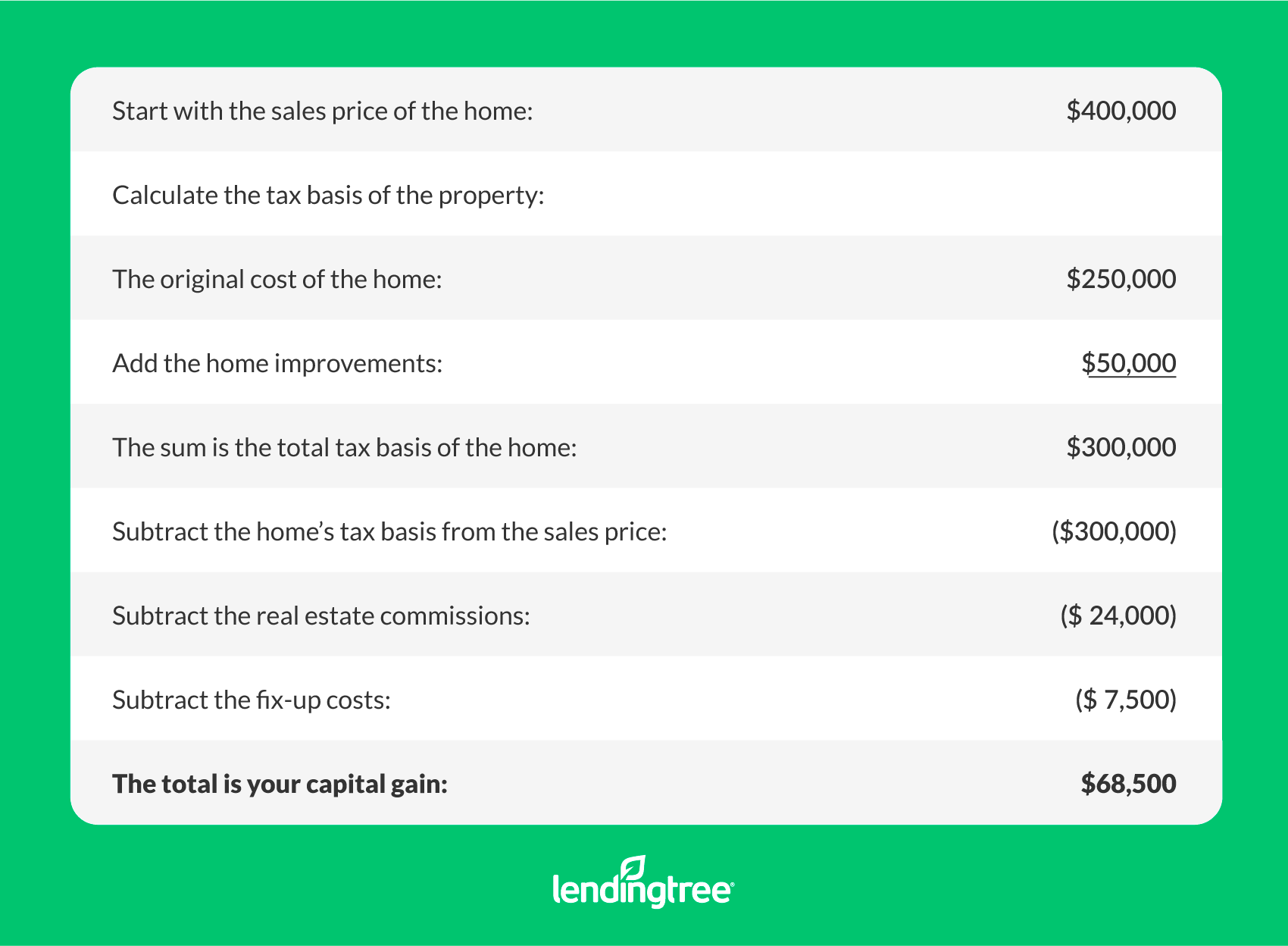

Capital Gains Tax On A Home Sale Lendingtree

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax What It Is How It Works Seeking Alpha

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Taxes In Spain Frequently Asked Questions

Capital Gains Tax Types Exemption And Savings Forbes Advisor India

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Money Isn T Everything Capital Gain

Spain Cryptocurrency Tax Guide 2022 Koinly

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Difference Between Income Tax And Capital Gains Tax Difference Between

Exemption From Capital Gain Tax Complete Guide

2022 Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Tax Relating To Property In Spain Molina Solicitors

Tax Calculator Estimate Your Income Tax For 2022 Free

Difference Between Income Tax And Capital Gains Tax Difference Between

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)